Reflecting on Progress: Key Milestones in Carbon Dioxide Removal - 2024 Edition

This annual summary encapsulates the significant developments that shaped the carbon removal field throughout 2024.

TABLE OF CONTENTS

1. Market Snapshot

2. Key Highlights

3. Government-led CDR Initiatives

4. Exciting Startup Funding Ventures and Significant High-Profile Announcements

5. Essential CDR Reads from 2024

6. Key CDR Resources

7. Personal Milestones

Download a PDF version of this post here for easy access:

MARKET SNAPSHOT

Throughout 2024, the Carbon Removal industry experienced noteworthy expansion, driven by significant corporate acquisitions, government funding initiatives, noteworthy fundraising efforts by emerging startups and high-profile announcements.

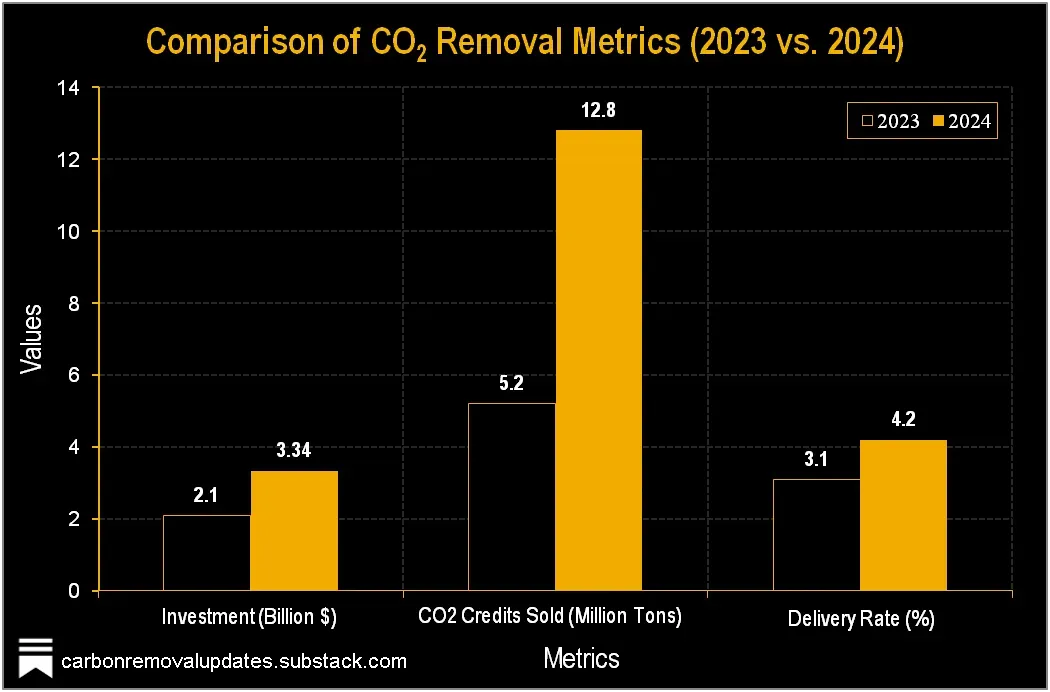

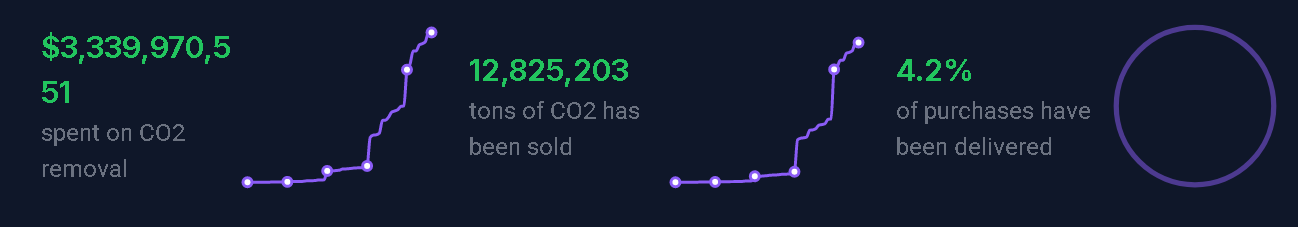

In 2024, investment in CO₂ removal increased by 59%, rising from $2.1 billion in 2023 to $3.34 billion. Similarly, the volume of CO₂ removal credits sold surged by 146%, with nearly 12.8 million tons sold in 2024, up from 5.2 million tons the previous year.

While these figures highlight substantial growth, the delivery of purchased credits showed more modest improvement. According to CDR.fyi, the percentage of purchases delivered rose by only 35%, from 3.1% in 2023 to 4.2% in 2024. Despite this progress, the delivery rate remains relatively low, underscoring persistent challenges the industry faces in scaling operations to meet surging demand.

Looking ahead, industry leaders anticipate a plateau in the CDR market. A top voice in the sector, Robert Hoglund warns of a potential crunch within the next 1-2 years due to sluggish voluntary demand, waning investor interest, and slow policy action. Along with other industry executives, he believes 2025 will primarily focus on survival, with significant attention on SBTi's proposal to include CDR in its net-zero standard.

KEY HIGHLIGHTS

Here are the top developments that defined the CDR landscape in 2024 (Source: Forbes written by Phil De Luna):

Direct Air Capture Project Expansion: New facilities like Climeworks' Mammoth plant in Iceland and Deep Sky Alpha pilot center under construction in Canada pushed planned global DAC capacity past 1 million tonnes worldwide.

Policy Momentum: The U.S. DOE announced new $1.8B funding in DAC, COP29 finalized carbon credit trading rules under Article 6, and Canada pledged $10M for CDR credits - signalling increased government and policy support for this emerging industry.

Record Investments: Startups like Heirloom ($150M Series B), CarbonCapture ($80M Series A), Deep Sky ($40M Breakthrough Energy Catalyst Grant), and Vaulted Deep ($32.3 million Series A) were among the many startups that secured funding to scale innovative CDR solutions this year.

Landmark Purchase Agreements: Companies like Morgan Stanley, Google, and Microsoft committed to long-term deals, boosting project funding and accountability. This year, Microsoft, Google, and British Airways were among the companies that committed a total of $1.6 billion to purchase removal credits. That figure was up from less than $1 million in 2019. Moreover, total DAC carbon credits reached more than 2.1 million tons sold for the first time.

Worldwide Carbon Dioxide Removal Purchases by Company (As of 2024)

Worldwide Carbon Dioxide Removal Credits Sold by Company (As of 2024)

Here's a yearly roundup of key developments in Carbon Removal field:

GOVERNMENT-LED INITIATIVES

US DOE invested $6B to cut carbon from steel, cement & snacks. The 6 selected cement & concrete industries were Brimstone Energy, Sublime Systems, National Cement Company of California, Roanoke Cement Company, Summit Materials, Heidelberg materials.

The European Union (EU) approved the aid of €3 billion program to support projects removing biogenic CO₂ emissions through permanent CCS in Sweden.

Four bipartisan members of the US Congress (Representatives Suzanne Bonamici, Paul Tonko, and Jenniffer González-Colón, and Senator Brian Schatz) introduced new legislation focused on developing federal programs for marine CDR over the next decade, which would appropriate more than $2.5 billion among various agencies.

The U.S. DOE announced plans to fund up to $1.8 billion to support the development of mid- and large-scale DAC facilities, advancing DAC technologies and expanding Regional DAC Hubs.

The Danish government announced that it will set aside $1.44 billion for a biochar carbon removal subsidy, while also becoming the first country in the world to introduce a carbon tax on livestock emissions.

The U.S. Department of Energy announced a $500 million grant for projects that can build a safe and reliable system to transport captured CO2 for permanent geologic storage or conversion to useful, durable products.

Denmark made largest ever government purchase (worth a total of roughly $166 million) of carbon removal.

Canada included $135M for carbon removal procurement in its 2024 budget.

The U.S. Department of Energy’s Office of Fossil Energy and Carbon Management announced a new funding opportunity of $127.5 million in carbon capture, removal, and conversion test centers.

The U.S. DOE announced a new program to invest $52.5 million in DAC technologies.

The U.S. Department of Energy announced the launch of a $100 million fund to support projects that remove, store, and utilize carbon from the atmosphere.

OCED issued $50M to Direct Air Capture hub project Cypress.

California Legislature passed 2024-25 budget, allocated $40 mln for carbon removal.

The European Union announced an Innovative Action Grant of €15 million under the Horizon Europe Programme to further the technological development of DACCS and BECCS projects in the continent.

The California Energy Commission launched a grant funding opportunity of $14.7 million to advance the technical, economic, and environmental viability of innovative DAC technologies to meet the state’s carbon neutrality goals.

Treasury Board of Canada Secretariat announced a $10 million carbon removal procurement program, making Canada one of the first countries to commit to purchasing carbon removal.

The U.S. Department of Energy (DOE) awarded $10 million in grant funding to the NREL, ORNL, andLLNL to collaborate with Prometheus Materials – and a team of partner institutions – to establish methods for measuring, reporting and verifying carbon dioxide removal and sequestration in cement and concrete.

The Western Australian government pledged AUD 8.6 million for the world’s largest biochar production facility in Pilbara.

As part of a recent announcement by the Canadian government, two CDR companies - Carbon Engineering and Arca were awarded CAD $5 million and CAD $1.8 million, respectively, along with 3 other non-CDR companies.

The Danish government issued its first permits for investigating carbon storage in underground sites.

NOAA, DOE signed agreement to advance marine carbon dioxide removal.

The U.S. DOE’s National Energy Technology Laboratory signed a 4-year MoU with the National Institute of Standards and Technology (NIST), an agency of the U.S. Department of Commerce, to advance the underlying measurement science for DAC systems and research.

Austria's federal government adopted a carbon management strategy including CDR, CCS & CCU as a contribution to achieving climate neutrality.

U.S. Senators Lisa Murkowski and Michael Bennet introduced a new bipartisan bill to support tax credit for CDR.

The EU Council greenlit a regulation to establish the Carbon Removals and Carbon Farming (CRCF) - a framework for certifying carbon removals, carbon farming, and storage.

The Japanese government announced to accept the use of durable carbon dioxide removal voluntary carbon credits in its national emissions trading system, the Green Transformation (GX) ETS.

The Canadian government announced its 2035 climate goals and also announced its commitment to solicit feedback from stakeholders on carbon removal’s role in Canada’s future economic and environmental ambitions.

EXCITING STARTUP FUNDING VENTURES AND SIGNIFICANT HIGH-PROFILE ANNOUNCEMENTS

FINANCING

Enfinium announced £1.7b Net-Zero Transition Plan.

Morgan Stanley Investment Management closed its 1GT climate private equity fund at $750 million that will focus on companies in North America and Europe aiming to avoid or remove one gigatonne of CO₂e emissions by 2050.

UK investment firm Astarte Capital Partners and Swedish forestry development company Silvipar raised $325m to finance Paraguay afforestation projects.

Heirloom raised $150M to expand its direct air capture technology.

TotalEnergies signed a $100 million agreement with Anew Climate and Aurora Sustainable Lands to preserve sustainable carbon sinks.

Canada Growth Fund and Svante announced a financing commitment of $100 million to accelerate the development and construction of Svante’s commercial carbon capture and removal projects in Canada and the US.

Direct air capture company CarbonCapture Inc. closed $80 million Series A financing.

Frontier announced $80 million in offtake agreements with CO280 and CREW Carbon to remove nearly 300,000tCO2.

Bern-based Neustark secured €64.3 million to exponentially accelerate carbon removal.

Frontier buyers signed $58.3M in offtake agreements with Vaulted Deep.

Terradot, an enhanced rock weathering company, successfully launched with $58.2 million in funding.

Apple announced that Taiwan Semiconductor Manufacturing Company & Japanese firm Murata Manufacturing invested $50M & $30M respectively, in its Restore Fund.

Frontier buyers signed $48.6M in offtake agreements with Stockholm Exergi, in first large European deal.

Carbon removal firm Captura expanded Series A funding to US$45.3M.

Frontier signed a $40 million offtake agreement to purchase 61,571 tonnes of CDR from Direct Air Capture company 280 Earth.

Deep Sky secured $40M grant from Breakthrough Energy to scale Direct Air Capture.

Oman-based ERW firm, 44.01 announced a $37 million Series A funding round which was led by Equinor Ventures and Shorooq Partners.

Avnos, a Los Angeles-based DAC company, raised $36 million in Series A funding to scale its Hybrid Direct Air Capture (HDAC™) technology.

1PointFive's Bluebonnet and Magnolia Sequestration Hubs received $36 million from the U.S. DOE under Phase III of the CarbonSAFE Initiative.

Meta announced a pledge of $35 million for carbon removal projects in the coming year, matching the DOE’s Carbon Dioxide Removal Purchase Pilot Prize.

Biomass direct storage company Vaulted Deep raised $32.3 million in Series A funding.

CDR startup Graphyte closed a $30 million Series A funding round to accelerate its CDR technology and operations.

Terradot secured a $27M deal with Frontier buyers to remove 90,000 tons of CO₂ in Brazil from 2025 to 2029.

Frontier signed a $25.4 million offtake agreement with CarbonRun to buy 55,442 tonnes of CDR, a first for Frontier via the River Alkalinity Enhancement method.

WHOI received $25 Million to accelerate search for ocean-based climate solutions.

Novocarbo raised €25 million in funding to establish a pan-European infrastructure network of its net-zero solution.

Dutch CDR startup Paebbl closed its Series A round of $25 million.

Salesforce committed $25 million to ‘steep learning curve’ of carbon removal.

Mission Zero raised £21.8M Series A to scale versatile direct air capture technology worldwide.

Captura raised US$21.5M, with investments from Maersk Growth, Eni Next and EDP.

Applied Carbon, a biochar technology company, raised $21.5 million in a Series A funding round.

Myno Carbon received $20.4M in funding from USDA Rural Development $20.4M to construct a large-scale biochar CDR facility.

NetZero locked in $18M investment from STOA to open new biochar facilities in Brazil.

Dutch DAC startup Carbyon secured an investment round of $16.9 million.

NREL collaborated on $15 Million multilaboratory efforts to advance commercialization of carbon dioxide removal.

Svante secured a CAD 15 million investment from InBC Investment Corp. to scale its operations, including a plant under development to capture 10 million tonnes of CO₂ a year.

Munich-based DAC company Phlair raised €14.5 million in seed funding.

Cultivo raised $14m from MassMutual Ventures and Octopus Energy Generation.

Cowboy Clean Fuels raised approximately $13 million in Series B equity financing to help the company in commercializing its technology, termed as Biomass with Carbon Removal and Storage, plus Renewable Natural Gas.

Ocean-based climate solutions company Planetary completed its Series A funding round of $11.35 million.

German Direct Air Capture startup Greenlyte raised €10.5 million to efficiently remove CO2 from the atmosphere.

Climate-tech startup CarbonBlue raised $10 million. The financing will support global expansion and advancement of its water-based CDR technology.

Green Cement Startup Cemvision raised €10 Million.

Carbon removal developer Planetary raised about $10 million in a Series A for ocean-based carbon removal.

A Scottish firm, Agricarbon that measures soil carbon achieved £9m of funding from global industry giants Shell and Barclays.

Varaha, an Indian regenerative agriculture firm, raised $8.7 million in Series A funding, led by RTP Global.

Perth-based biomass storage startup InterEarth secured an $8.25 million deal with Germany’s Securing Energy for Europe (SEFE) to advance its CDR technology.

German DAC company Ucaneo closed a seed funding round for $7.45 million.

TerraFixing signed $7.3M commercial direct air capture agreement.

Carbonx procurement round attracted $7M for CO2 Removal.

AirMyne came out of stealth mode with a $6.9M seed round to explore their liquid solvent low-temperature regeneration.

Clairity Technology, a California-based DAC startup, raised $6.75 million in seed funding. The funding round was co-led by Lowercarbon Capital and Initialized Capital.

Cleantech Startup Furno raised $6.5 Million to dcarbonize cement production.

Sirona Technologies, an European DAC firm raised €6m to build Kenya pilot plant.

Aviva pledged $6M to Nature Conservancy of Canada for conservation and nature-based carbon removal projects.

Net Zero Company secured $5.5M seed for blockchain-based carbon removal token.

Enhanced weathering startup CREW Carbon completed its seed round funding of $5.3 million.

Mekong Capital’s Mekong Enterprise Fund IV invested $5 million in HUSK, a Cambodian biochar and biofertiliser firm.

Milkywire announced a $5M prepurchase deal with Salesforce to boost durable carbon removal.

Frontier announced prepurchases of CDR worth $4.5 million from 9 companies - Alithic, Alt Carbon, Anvil, Capture6, Exterra, Flux, NULIFE, Planeteers, and Silica, on behalf of its buyers via Watershed.

Downforce Technologies secured $4.2 million in funding to measure carbon stored in soil.

ecoLocked raised €4M to tackle the construction industry’s carbon footprint and enable 1Gt of carbon removal by 2040.

Octavia Carbon announced a seed round of $3.9 million and $1.1 million in carbon financing.

Parallel Carbon secured $3.6 Million Seed Funding to advance hydrogen and direct air capture hardware platform.

Truecoco Ghana raised $3.3 million from Growth Investment Partners Ghana to expand its soybean processing operations and fund the launch of an industrial biochar carbon removal project, a first in Ghana.

Terraset made its largest ever CDR purchase, nearly $3 million to purchase over 5,000 tonnes of CDR from 11 suppliers.

Everest Carbon, a startup developing a sensor for monitoring carbon removal, has officially launched and secured $3 million in funding.

Yama secured $3 million in funding to scale their breakthrough hybrid electrochemical direct air capture technology.

Concrete4Change UK startup cemented £2.5M funding to pioneer CO2 mineralisation in concrete.

Montreal-based CDR project developer Deep Sky secured a fresh investment of $2.5 million CAD from financial institutions National Bank of Canada and BMO.

Amsterdam-based startup Brineworks raised $2.2 million in a funding round to advance its innovative Direct Ocean Capture technology.

Paebbl secured a $2.2 million Demonstration Energy and Climate Innovation (DEI+) grant awarded by the Dutch Ministry of Climate Policy and Green Growth, which will help scale up its demo plant.

Seqana, a Berlin-based provider of a SaaS platform that measures the climate impact of carbon farming projects, raised €2.1M in Seed funding.

Dutch Direct Ocean Removal startup SeaO2 raised over €2 million in seed funding.

The British Columbia Centre for Innovation and Clean Energy announced an investment of $2 million in ocean-based CDR projects, most notably in Planetary Technologies and Coastal Carbon, to assess effectiveness and impact on coastal communities and marine environments.

Blusky Carbon launched CO2 removal and secured initial US $1.94 Million in sales.

Metalplant, which uses enhanced weathering to mine nickel while removing CO₂, announced that it had received $1.72 million from ARPA-E's PHYTOMINES program, which funds research into phytomining and development of low-carbon nickel.

Sun Cable OGs raised $1.7 million Seed round for their carbon removal & recycling startup, Fugu.

Australian DAC startup Fugu Carbon closed its Seed funding round of $1.67 million.

Carbominer secured €1.5M grant from EIC Accelerator.

Ocean Visions announced a new investment of up to $1.5 million for the development of an Environmental Impact Assessment Framework for marine CDR.

Biochar developer Bio-logical raised $1.3 million in funding. The funding will expand Bio-Logical's Mt. Kenya biochar facility to meet the growing demand for carbon removal and support climate resilience for Kenyan smallholder farmers.

Planboo secured over $1.1 Million in funding to scale carbon removal with biochar MRV technology.

Bezos Earth funded $1M Greenhouse Gas Removal Ideation Prize.

Carbon removal and agtech startup Cotierra secured $1 million in a pre-seed funding round for its decentralized biochar production, aimed at decarbonizing coffee farming.

The 4 Corners Carbon Coalition, a group of cities and counties in the Western U.S., awarded $335,000 to four projects aimed at combating climate change and reducing wildfire risks. These projects will use advanced CDR approaches to transform organic waste into valuable resources like biochar.

Toucan Protocol announced a total of $250k in grant funding available to apps integrating CHAR: the world's first onchain carbon dioxide removal credit pool.

PARTNERSHIPS

Microsoft signed deal to capture and store carbon in recycled concrete with startup Neustark.

Microsoft signed a 10-year BECCS offtake agreement with Swedish energy company Stockholm Exergi to purchase 3.33 million tons of CDR.

Microsoft expanded their agreement with Ørsted, committing to an additional 1 million tons of BECCS carbon removal over a ten-year period.

Google and Holocene signed an offtake agreement worth $10 million for a sale of 100,000 tonnes of CDR.

Project Carbonity entered a forward contract with Microsoft to sell 36,000 tons of biochar carbon removal over a 3-year period.

Climeworks and financial services company Morgan Stanley signed a 10-year agreement for 40,000 tonnes of CDR.

NextGen CDR signed an offtake agreement with India-based enhanced weathering startup Alt Carbon to purchase the CDR credits at an average price of $200/tonne for 2025-30 delivery.

Ebb Carbon signed an agreement with Microsoft on the sale of 1,333 tonnes of CDR, with the potential to go up to 350,000 tonnes over the next 10 years.

CapturePoint partnered with Climeworks to transport CO₂ from Climeworks' DAC facility in Louisiana-based Project Cypress DAC Hub to its CENLA Hub for permanent underground storage in Class VI wells.

Climeworks announced its plans to build a new facility in southwest Louisiana as part of the Project Cypress DAC Hub. It plans to mobilize $50 million in private investments to match the $50 million already provided for the project by the DOE.

Origen Carbon announced a partnership with the Energy and Environmental Research Center (EERC) in North Dakota to advance the commercial development of its limestone-base DAC solution at 1,000 tonnes per annum scale.

Kumo announced a new partnership with biochar marketplace biochar zero to support biochar developers in accessing institutional debt financing across Europe.

CEEZER partnered with MRV providers Carbonfuture, Cula, Mangrove Systems, and Kanop to enhance monitoring data for over 9,000 carbon projects on its platform.

London Marathon Events signed its third deal with CUR8 to purchase 1,935 tonnes of carbon removals.

Climeworks signed 9-year agreement with the LEGO Group and KIRKBI.

Carbonfuture signed a 7-year agreement with insurance group Swiss Re to supply 70,000 tonnes of Biochar Carbon Removal (BCR) from leading BCR supplier Exomad Green’s new Riberalta facility in Bolivia.

Isometric announced partnerships with 12 leading climate companies to provide their end customers access to Isometric's carbon credits.

Exomad Green and Senken announced a multi-year deal for 81,600 tons of CDR.

Ecospray and Captura partnered on Breakthrough seawater CO2 removal project.

Deep Sky and Skyrenu partnered to deploy carbon removal technology in Canada. Skyrenu will install a DAC unit that can remove 50 tonnes of CO₂ per year.

Capture6, K-Water and BKT announced an agreement to build a facility in South Korea, that uniquely combines seawater desalination and carbon dioxide removal, a global first in water management decarbonization.

Carbfix and Kenya’s Great Carbon Valley signed a Memorandum of Understanding to jointly explore the development of CO2 mineral storage in Kenya.

Google agreed to purchase 200,000 tonnes of carbon removal credits from Terradot.

PyroNam, a subsidiary of PyroCCS, partnered with atmosfair to scale biochar carbon removal in Namibia.

Carbonx Climate announced that it purchased 2,699 tons of biogenic carbon removal from Carbon Capture Scotland on behalf of its clients.

Climeworks commenced operations on its Project Mammoth facility in Iceland.

Deep Sky and Sustaera signed an MoU to explore the deployment of a Sustaera unit at a future Deep Sky facility in Canada. Once completed, the unit will remove 1,000 to 5,000 tons of CO₂ annually.

Airfix and project developer Carbon Impact announced a partnership to establish France’s first biogas-based BiCRS initiative.

Rockwell Automation announced direct air capture carbon removal credit agreement with 1PointFive.

Microsoft signed largest-ever nature-based carbon removal deal with BTG Pactual.

Carbonfuture, Puro.earth, PYREG and Syncraft united for groundbreaking initiative to enhance transparency in CDR tracking.

Boston Consulting Group announced a strategic agreement with 1PointFive, including the purchase of 21,000 metric tons of CDR credits over three years.

Bobo's partnered with Acorn, purchased carbon removal units, supporting sustainable local agroforestry farming practices around the world.

Viridis Terra collaborated with Amazon on innovative agroforestry project in the Peruvian Amazon Rainforest.

Babbily joined forces with Stripe Climate to contribute 1% of revenue to carbon removal efforts.

Airfix and The Carbon Removers announced a strategic partnership to accelerate the deployment of CDR solutions, with a primary focus on BECCS across the UK, Denmark, and the Netherlands.

Neustark and Thurgauer Kantonalbank partnered to remove 100tCO2 from the atmosphere every year (starting from 2026), and permanently storing it in recycled concrete.

Pension Insurance Corporation partnered with CUR8, purchasing 800+ tonnes of CDR to offset emissions from its new London office fit-out.

Berlin-based climate tech startup SQUAKE, which provides carbon calculations for travel and logistics emissions, announced a partnership with Carbonfuture. The partnership will allow SQUAKE to add durable CDR projects to its portfolio using Carbonfuture’s data-powered MRV system.

The Carbon Removers secured a landmark deal to sequester 50,000 tonnes of CO₂ per year, permanently beneath the North Sea.

NYK and ENEOS partnered to decarbonize marine fuels, with ENEOS set to procure CDR credits from 1PointFive's STRATOS DAC plant in Texas, starting in 2025.

Boomitra and Mongolian Government signed agreement to introduce regenerative agriculture and carbon finance in Mongolia.

Weyerhaeuser marked its first transaction in the voluntary carbon market by inking an agreement to sell nearly 32,000 forest carbon credits at $29 per credit.

CarbFix and Kenya’s Great Carbon Valley signed a Memorandum of Understanding to jointly explore the development of CO2 mineral storage in Kenya.

Siemens Energy partnered with the Abu Dhabi Department of Economic Development to promote decarbonization in the emirate's industrial sector and help advance carbon removal technology.

DAC company RepAir and EnEarth, which specializes in carbon storage and environmental services, announced a partnership to capture and store CO₂ using RepAir's DAC technology in Greece. The project is expected to capture 3 million tonnes of CO2 annually in 2028.

Gentoo.earth partnered with AirMyne to unlock the supply of durable carbon removals by providing project developers with tools & insights to accelerate their commercialization strategy.

Biochar producer NetZero and social impact investor Oikocredit announced a partnership for a first-of-a-kind project finance scheme involving mid-size biochar production factories in rural areas of developing countries.

Flux and African Food Security signed MOU to launch 205,000 ha ERW Project in the Republic of Cameroon.

Octavia Carbon announced 950 tons of pre-purchase carbon credit by Klimate.co.

Isometric and [C]Worthy partnered to advance marine carbon dioxide removal research.

Petrofac teamed up with Aggregate Industries UK to explore the potential for carbon capture at the Cauldon cement plant in the United Kingdom.

Carbon RX and King Tide Carbon signed strategic MOU to elevate carbon sequestration and soil health.

Klimate.co and Carboneers inked deal for purchase of 4,500 tons Of carbon removals.

Drax partnered with Molpus Woodlands to fuel BECCS operations in the Southeast US.

NetZero partnered with ECOM trading for the deployment of biochar in coffee farming.

Global Thermostat commissioned first containerized T-Series system for multi-tonne Direct Air Capture of carbon dioxide.

PicoNext and Tomorrow’s Air collaborated for transparent carbon removal.

BeZero Carbon and General Index partnered to marry carbon credit quality with price.

Waterford-based company NEG8 partnered with Canadian developer to cut C02 emissions.

Soletair Power signed an agreement with Danica Pension in Denmark to deliver an HVAC integrated direct air capture unit.

Kenya-based DAC company Octavia Carbon partnered with CEEZER to offer CO2 credits on the latter’s carbon marketplace platform.

Microsoft and 1PointFive signed an offtake agreement on a deal for 500,000 tonnes of CDR.

Oxy Low Carbon Ventures (OLCV), a subsidiary of Occidental, partnered with TAE Technologies to explore using TAE’s fusion technology for emissions-free power and heat in DAC facilities.

Equatic partnered with Deep Sky to build North America's first commercial-scale ocean-based CDR plant. It planned to remove 109,500 tonnes of carbon dioxide annually and produce 3,600 tonnes of green hydrogen.

Heirloom announced an investment in northwestern Louisiana to build two DAC facilities to remove nearly 320,000 tonnes of CO2 annually and create around 1,000 new clean energy jobs.

CarbonCapture Inc secured a lease to build the world’s largest DAC manufacturing facility while announcing its new Leo Series modular DAC system, designed for mass production. Each module can capture over 500 tonnes of CO2 annually, with the first modules to be deployed in 2025.

Capture6 and Veolia Water Technologies & Solutions announced a global collaboration agreement to deploy CDR facilities with integrated water management systems to address climate change.

NEG8 Carbon, Ireland’s first DAC company, partnered with the Walton Institute to optimize its DAC technology using AI and machine learning.

TCC and thyssenkrupp Polysius partnered on new carbon capture tech.

Climate company Spiritus removed carbon from Taylor Swift’s football flight from Japan.

Catona Climate partnered with Microsoft to deliver 350,000 tonnes of carbon removal through agroforestry project.

Lithos Carbon announced 3,000 ton carbon removal purchase.

Cella Mineral Storage and Carbon Atlantis partnered on a demo pilot in Kenya.

Microsoft announced to acquire 10,000 credits from biochar startup Bio-Logical.

Weyerhaeuser and Lapis Energy announced carbon sequestration exploration agreement.

Danish Energy Agency awarded CDR procurement contracts worth 1.1 million tons of CDR to three companies - Biocirc, Bioman ApS, and Carbon Capture Scotland.

Neustark entered multi-year offtake agreement with NextGen CDR.

Brineworks and the ITC joined forces to test and validate innovative brine valorisation processes in real environment coupled with Ocean-Based CO2 Removal.

The SLB and Aker Carbon Capture joint venture announced a contract with BECCS company CO280 for the front-end engineering and design (FEED) of a carbon capture plant at a U.S. Gulf Coast pulp and paper mill, with a capacity to remove 800,000 tonnes of CO₂ annually.

Octavia Carbon and Thallo partnered to offer carbon removal credits from Octavia's Kenyan DAC facility through Thallo's platform.

Carbon rating agency BeZero Carbon partnered with EcoRegistry to expand its carbon credit ratings in emerging markets, including Latin America.

Neustark, NextGen CDR announced the purchase of mineralized CO2 in demolished concrete from 18 projects across Switzerland, Germany, and other European countries.

PyroCore & INOE partnered to produce 4,000 tonnes of biochar annually for soil regeneration, sequestering over 12,000 tonnes of CO2 per year.

Cula and Callirius partnered to enhance trust and transparency in biochar projects.

Environmental consultancy C-Zero announced a deal to buy 2,000 tons of CDR from power generation group Drax.

Vaulted Deep, a BiCRS company, announced the delivery of 1,666 tons of CDR to Frontier.

Microsoft and Royal Bank of Canada (RBC) purchased 10,000 tonnes of CDR from Canadian project developer Deep Sky.

Insurance group AXA Switzerland announced the purchase of 1,950 tonnes of CDR from InPlanet and 1,800 tonnes from Neustark, respectively.

Ørsted entered into an agreement to sell 330,000 tonnes of CDR credits to Equinor over the next 10 years.

Microsoft announced three new deals to purchase 34,400 tonnes of CDR from Enhanced Weathering companies - UNDO (15,000 tonnes), Lithos Carbon (11,400 tonnes) and Eion (8,000 tonnes).

Microsoft and Arbor announced a new agreement for the delivery of 25,000 tonnes of CDR.

Standard Chartered and SEB partnered with Puro.earth to offer offtake agreements from Puro Standard-certified CDR projects to their clients.

Climeworks announced a new partnership with non-profit climate fund Terraset to enable an impact-driven way to support Climeworks and unlock philanthropic capital to accelerate and deploy its carbon removal solutions.

Standard Chartered, British Airways, CUR8, CFC, and WTW partnered to complete a first-of-its-kind debt financing deal for UK-based enhanced weathering developer UNDO.

Climeworks announced that it has signed an agreement with British Airways to remove CO₂ emissions from the air on behalf of the airline, using its technology.

Montana Technologies, the developer of AirJoule® atmospheric water generation technology, signed an MoU with DAC company Clairity Technology to deploy AirJoule® units to support Clairity’s DAC operations.

UK insurer Pension Insurance Corporation (PIC) purchased a portfolio of carbon removals supported by CUR8, to neutralize its operational emissions.

MaRS Discovery District, purchased CDR credits from five Canadian ventures - Arca, Gaia Refinery, Planetary Technologies, TerraFixing, and CarbonRun, through its Mission from MaRS program.

TOWING and Biocare announced multi-project, global agriculture carbon removal partnership.

Planetary delivered the world’s first Ocean Alkalinity Enhancement (OAE) credits to Frontier Buyers - with allocations to Shopify (96 tonnes) and Stripe (42 tonnes) under a 2023 prepurchase agreement.

Auto Trader partnered with enhanced weathering company UNDO to spread 1,839 tonnes of basalt rock on UK farmland, permanently removing around 340 tonnes of CO₂.

Kenya-based project developer Great Carbon Valley and French DAC company Yama entered into a partnership to integrate DAC and energy technologies to establish sustainable carbon removal and green industrial hubs in key locations across the Great Rift Valley.

Skytree announced a strategic partnership with Finnish manufacturing firm Scanfil to advance its manufacturing scale. Skytree’s Cumulus and Stratus units will have Scanfil as its manufacturer.

Carbonx purchased 900 tons of carbon removal from Inplanet, an enhanced rock weathering firm, on behalf of their clients.

UCLA Institute for Carbon Management and Equatic announced to build the world’s largest ocean-based CDR plant in Singapore.

The Mercedes-AMG PETRONAS F1 Team announced an investment round in carbon removal initiatives, starting with a project by Frontier. This supports their commitment to reduce emissions by 75% by 2030 and achieve SBTi-aligned net zero goals by 2040.

Sirona Technologies, Cella and Great Carbon Valley partnered on Kenyan DAC hub.

Climeworks partnered with SWISS and Lufthansa Group.

Carbonx Climate on behalf of their clients purchased 3,000 metric tons of carbon removal from Novocarbo.

CDR marketplace Supercritical and biochar producer Exomad Green entered into a partnership to offer buyers exclusive access to 100% of Exomad Green’s remaining 2024 biochar credits, which represents 50% of the total remaining biochar market supply for 2024.

1PointFive and AT&T announced DAC agreement.

Carbonx partnered with Boston Consulting Group (BCG) and Exomad Green on CDR purchase.

Terraset announced its first purchase of carbon removal credits from DACCS company Climeworks.

Isometric issued 107.21 carbon removal credits from Charm Industrial to JPMorgan Chase, Shopify, and Stripe. The ex-post credits were certified under Isometric’s Bio-oil Geological Storage Protocol.

Removr partnered with digital simulation leader Billington to accelerate and de-risk industrial-scale DAC deployment.

The Next 150 inked 6-year agreement with Microsoft for 95,000 high-quality biochar carbon removal credits.

Carbonfuture and Octavia Carbon joined forces to deploy the first digital monitoring, reporting, and verification system for DAC.

Karbon-X teamed up with Drax for BECCS collaboration in U.S.

Aker Carbon Capture and CO280 formed strategic alliance to develop carbon removal projects in the pulp and paper industry.

Avnos partnered with Deep Sky to construct and set up a Hybrid DAC Air Handling Unit (AHU) at Deep Sky Labs, Canada.

Neustark, along with utility company SIG, launched the first CO₂ source site in French-speaking Switzerland, capturing up to 1,500 tonnes of biogenic CO₂ annually for permanent storage with local construction recyclers.

Neustark announced a partnership with Aggregate Industries to introduce a new technology that permanently removes carbon from the atmosphere and locks it into recycled concrete.

Climeworks partnered with research institute King Abdullah Petroleum Studies and Research Center (KAPSARC) to assess DAC feasibility, integrate renewable energy, and advance CO₂ storage, supporting Saudi Arabia's sustainability goals.

Isometric partnered with seven leading digital MRV providers, including Mangrove Systems, Carbonfuture, and Cula, to deliver real-time data for carbon removal.

The National Oceanic and Atmospheric Administration (NOAA) and the non-profit Carbon to Sea Initiative partnered to establish guidelines to ensure consistency and comparability in mCDR projects.

Biochar project developer agriCARBON entered into an agreement with Carbonfuture to sell 6,000 tonnes of CDR from its pilot.

RepAir Carbon Capture and C-Questra announced plans to develop the EU's first onshore CDR project in France, featuring an energy-efficient DACCS technology intended to reduce energy use by 70%. The project aims to remove 100,000 tonnes of CO₂ annually by 2030, with the potential to reach megatonne levels by 2035.

Climeworks and Swiss bank Zürcher Kantonalbank announced a multi-year contract which included a purchase of 1,750 tonnes of CDR to complement the Swiss bank’s net zero strategy.

CarbonCapture Inc. and material science company W. L. Gore & Associates (Gore) announced a multi-year collaboration to develop advanced structured sorbents for more efficient atmospheric carbon removal.

Mangrove Systems announced a partnership with Carbon Capture Scotland to introduce the world’s first digital MRV system designed to support the precise tracking of CO₂ from biogenic carbon removal projects.

NextGen CDR signed a multi-year offtake agreement with Bolivia-based biochar producer Exomad Green for 36,000 tonnes of CDR.

PROJECTS

Skytree announced the availability of Skytree Stratus Hub that has a capacity to capture 10,000 to over 1 million tonnes of CO₂ per site annually.

Babcock & Wilcox announced plans to convert a former coal-fired plant in Michigan to a BECCS facility with the capacity to capture and store 550,000 tonnes of CO2 annually.

Heirloom announced an investment in northwestern Louisiana to build two DAC facilities to remove nearly 320,000 tonnes of CO2 annually.

Nordbex announced the launch of its first BECCS plant in Nybro, Sweden that has ability to capture 200,000 tonnes of CO₂ a year.

RepAir Carbon Capture and C-Questra announced plans to develop the EU's first onshore CDR project in France, using energy-efficient DACCS technology to cut energy use by 70%. The project aims to remove 100,000 tonnes of CO₂ annually by 2030, with potential to reach megatonne levels by 2035.

Exomad Green announced the expansion of its Concepción Biochar Production Facility in Bolivia, allowing it to double its CO₂ removal capacity from 60,000 tonnes to 120,000 tonnes annually by 2025.

Skytree was selected as a technology provider for Project Concho, the world’s first DAC hub powered entirely by wind energy. The project, located in Tom Green County, Texas, will initially capture 30,000 tonnes of CO₂ annually with plans to scale up to 500,000 tonnes per year.

Deep Sky launched Deep Sky Labs, the first DACCS innovation center, in Alberta, Canada. Powered by 100% solar energy, it will capture 30,000 tonnes of CO₂ over 10 years.

A Healthier Earth announced plans to build the UK’s largest biochar facility in Wiltshire with PYREG, producing 9,000 tonnes of biochar annually and storing 17,000 tonnes of CO2 from 2025.

NetZero launched its new biochar project in Brazil in the state of Espírito Santo. The new facility will produce 4,000 tonnes of biochar annually while removing over 6,000 tonnes of CO₂ per year.

Heimdal in collaboration with CapturePoint launched its first DACCS facility, Project Bantam, in Shidler, Oklahoma that has a capacity to capture over 5,000 tonnes of CO₂ annually.

Project Vesta launched its Coastal Carbon Capture pilot in Duck, North Carolina, projected to remove 5,000 metric tonnes of CO₂ net of emissions.

The Carbon Removers announced its expand into Denmark in 2026, capturing and storing 4,650 tonnes of biogenic CO₂ annually through 2032.

Neustark, along with utility company SIG, launched the first CO₂ source site in French-speaking Switzerland, capturing up to 1,500 tonnes of biogenic CO₂ annually for permanent storage with local construction recyclers.

Octavia Carbon unveiled its pilot Project Hummingbird at its site in Kenya’s Rift Valley that aims to capture 1,000 tonnes of CO₂ per year.

Limenet, which specializes in OAE launched its first industrial plant in Augusta, Italy, capable of removing 800 tonnes of CO₂ annually.

Carbon Plus launched Malaysia’s first industrial biochar facility to produce 500 tonnes of biochar annually.

CarbonCapture Inc secured a lease for the world’s largest DAC manufacturing facility and unveiled its Leo Series modular DAC system, capturing 500+ tonnes of CO₂ annually per module, with deployment set for 2025.

44.01 and UAE-based oil company Abu Dhabi National Oil Company (ADNOC) announced plans to scale up mineralization in the Emirate of Fujairah. The first phase of the scale-up will inject more than 300 tonnes of CO₂.

Phlair announced its Rotterdam plant, Electra 01, will begin operations in 2025, removing 260 tonnes of CO₂ annually using its patented Hydrolyzer technology with storage partner Paebbl.

Vycarb, specializing in carbon removal and storage, unveiled its pilot project in New York City’s East River that will utilize water and minerals to remove and store 100 tonnes of CO₂ annually.

Spiritus announced manufacturing capabilities in a new facility in Missouri that will exclusively produce the novel sorbent material that will enable its Orchard One project to passively remove CO₂ from the air.

Halifax, Canada-based River Alkalinity Enhancement company CarbonRun inaugurated its West River Pictou project to neutralize river acidity and restore the river’s ability to transport carbon to the ocean.

CapChar launched a network of on-farm biochar production facilities in the UK, aiming to decarbonize agriculture and generate carbon removal credits.

Spiritus launched a pilot plant in New Mexico with support from the Nambé Pueblo Development Corporation to demonstrate and test its DAC technology.

Captura announced its plans to expand its research, development, and demonstration efforts in Hawaii and Los Angeles.

Climeworks announced its plans to build a new facility in southwest Louisiana as part of the Project Cypress DAC Hub.

Klimate in collaboration with Mammut, ARC, Bofort, and Carbonaide, launched a new project for carbon removal and its storage in concrete in Copenhagen.

Carbon Collect launched the 2nd generation of its MechanicalTree™ technology, announcing that it is on track to achieving DACCS below $200 per tonne by 2030.

Avnos launched its new facility in Bridgewater, New Jersey that can yield 5 tonnes of liquid distilled water for every tonne of CO₂ captured.

Alt Carbon launched the “Darjeeling Climate Action Lab (D-CAL),” a new facility to advance Enhanced Weathering (EW) research in India.

Carbon Neutral Initiative initiated its first Enhanced Weathering pilot project in Spain.

ESSENTIAL CDR READS FROM 2024

The State of Carbon Dioxide Removal (Edition 2)

Boosting Demand for Carbon Dioxide Removal (BCG)

2024+ Market Outlook Summary Report (CDR.fyi)

SBTi Corporate Net-Zero Standard (SBTi)

2024 CDR salary report (CDRJobs)

Pioneering Marine CDR Policy (Rewind)

Direct Air Capture Deployment and Economic Opportunity: State-by-State (Rhodium Group)

CDR Offtakes Report (Puro.earth)

Procuring with Purpose (Carbon Removal Canada)

The Procurement Toolbox: Building Blocks for Carbon Removal Policy (Carbon180)

Bridging the CDR Financing Gap - The Comprehensive Guide (ClimeFi)

Europe and Germany’s Role in Catalyzing a Trillion-Euro Industry (BCG)

Unlocking net-zero: Scaling carbon dioxide removal (Milkywire)

Agenda For A Progressive Political Economy Of Carbon Removal (Institute for Carbon Removal Law and Policy)

AlliedOffsets & Carbon Herald's 2023 CDR Market Report (Allied Offsets)

Large-scale carbon dioxide removal and dual accounting: Microsoft and Ørsted (Carbon Direct)

Scaling Technological Greenhouse Gas Removal: A Global Roadmap to 2050 (Bezos Earth Fund)

Trending on Track? - CDR.fyi 2023 Year in Review (CDR.fyi)

Harnessing the Land Sector to Achieve U.S. Climate Goals (America is All In)

Policy Incentives to Scale Carbon Dioxide Removal: Analysis and Recommendations (RFF)

Understanding Tech-based CDR (Sylvera)

Ready for Offtake: US Leads Expanding Global Market for Engineered Carbon Removal (Puro.earth)

Establishing quality in carbon removal: a roadmap for MRV (Carbon Removal Alliance)

From Bold Ideas to Exponential Impact (BCG)

Consensus on Carbon Dioxide Removal A Large-Sample Expert Elicitation on the Future of CDR (Institute for Policy Integrity)

Technological Innovation Opportunities for CO2 Removal (US DOE)

The Balancing Act: Risks and Benefits of Integrating Permanent Carbon Removals into the EU ETS (Clean Air Task Force)

Criteria for High-Quality Carbon Dioxide Removal (Carbon Direct)

CDR Accounting— Transparently structuring cooperate claims to reconcile with national goals (Microsoft)

MaRS Discovery District Carbon Dioxide Removal Pre-purchase (Pembina Institute)

Monitoring, reporting and verifying carbon removal (Isometric)

Breaking Barriers in Carbon Dioxide Removal with Electrochemistry (RMI)

Primed for growth: learnings from one year of engineered CDR ratings (BeZero)

The Top 100 Teams of XPRIZE Carbon Removal (XPRIZE)

EU – US Carbon Removal Policy Comparison (Carbon Gap)

A Manual for Biochar Carbon Removal (International Biochar Initiative)

Three Companies Own 45% of All DAC Patents: A CDR Patent Analysis (Allied Offsets)

Boom or Bust?—2024 Biochar Market Outlook (Supercritical)

The 2024 Buyer's Guide to Carbon Removal Policy (Carbonfuture)

Building Our Way To Net-Zero: Carbon Dioxide Pipelines In The United States (Global CCS Institute)

Unlocking The Potential Of Carbon Dioxide Removal—Six priority actions the UK can take to accelerate CDR (Oliver Wyman)

The Landscape of Carbon Dioxide Removal and US Policies to Scale Solutions (Rhodium Group)

The Complete Guide for CDR Suppliers to Access the Carbon Market (Carbonfuture)

Measurement, Reporting, and Verification for Novel Carbon Dioxide Removal in US Federal Policy (World Resources Institute)

Quantifying and Deploying Responsible Negative Emissions in Climate Resilient Pathways (NEGEM)

Foundations for Carbon Dioxide Removal Quantification in ERW Deployments (Cascade Climate)

Adapting to an Evolving Market-The Diverse Business Model Strategies of European CDR Startups (Remove)

Carbon Dioxide Removal and the Journey to Net Zero – A Call to Action for Business (wbcsd)

State Authority to Regulate Ocean Alkalinity Enhancement (Sabin Center for Climate Change Law)

KEY CDR RESOURCES

Andrew Lockley launched Carbon Removal Events Calendar, a community resource aimed at providing timely updates on events, conferences, webinars, funding opportunities, and job deadlines in the CDR field.

Ocean Visions released an interactive database for marine carbon removal (mCDR) that includes MRV strategies, carbon dioxide sequestration, mCDR pathways, maps, and more learnings from their trials.

Carbon Gap released its CDR Strategy for Europe, offering 18 actionable policy recommendations for how the EU could support carbon removal over the next thirty years as part of an EU CDR strategy.

DAC Coalition and AlliedOffsets released the Global DAC Deployment Map - an interactive map that features locations of DAC facilities worldwide, up-to-date information in the field of DAC, and detailed insights into facilities.

Carbonfuture released a guide for CDR buyers, which aims to help companies understand the latest policy changes in the US and EU and deep-dive into regions such as Germany, Denmark, and California.

Leila Conners directed and produced Legion 44, a documentary film about the rise of CDR: featuring the innovators, the countries, the potential to make everything right again.

CDR.fyi released an article entitled Standards, Methodologies and Protocols in durable carbon removal that analyzed and integrated 35 different methodologies and protocols into a downloadable resource to aid stakeholders and enhance transparency and trust.

CDR marketplace Supercritical launched live pricing and availability for global biochar projects on its platform, covering 80% of high-quality biochar solutions and promoting transparency in the carbon removal industry.

OpenAir Collective released a Large Language Model (LLM) exclusively for building knowledge on CDR. The AI tool deepens science-based understanding of CDR and is free for everyone - policymakers, journalists, and the general public.

Climate Impact Partners launched a program to enable companies of all sizes to fund innovative CDR technologies, accelerating the deployment of high-permanence solutions.

Carbon Removal Standards Initiative (CRSI) launched by Anu Khan that aims to provide technical assistance to NGOs and policymakers to develop and implement CDR policies, with a unique focus on quantification standards.

White House Office of Science and Technology Policy released National Marine Carbon Dioxide Removal Research Strategy.

Unbound Summits launched two new tools - Unbound Directory, a new “yellow pages” of CDR with over 2,500 professionals, and Unbound Library, a content repository to inform and orient the CDR industry.

Grantham Research Institute and AlliedOffsets developed a new tool called TRACEcdr to visualize how CDR methods are connected to MRV, registries, and national regulations.

CarbonPlan launched an interactive tool in partnership with [C]Worthy to explore global patterns in OAE efficiency across regions and seasons over time.

CDR.fyi released CDR Data Insights, a new tool exclusive to CDR.fyi Data Partners and Platform Subscribers that provides advanced analytics & insights into the state of the market.

Carbon Gap released the CDR Research Gaps Database to offer an overview of existing research gaps in the field.

Shopify launched Carbon Commerce, a platform for the online sale and purchase of carbon credits.

Sebastian Manhart launched CDRjobs with an aim to curate a database of all job openings in CDR.

Rewind announced the release of its new protocol, Framework Protocol for Marine Terrestrial Biomass Storage, which includes a detailed approach to quantifying net carbon removal while monitoring and preserving the aquatic environment.

World Climate Research Programme launched a Lighthouse Activity on Climate Intervention Research.

Rocky Mountain Institute (RMI) released an article breaking down the scale of CDR needed by 2050. It also discusses the significant investments, workforce, and supply chain changes necessary to achieve this scale compared to other large industries.

Puro.earth released a CDR policy meta-map highlighting the progress made by governments, international organizations, and voluntary rule-setters in defining net-zero emissions, thereby creating demand for durable carbon removal.

PERSONAL MILESTONES

In addition to the Carbon Removal Updates Substack Newsletter, we manage several other science communication micro-brands, all accessible free of charge. These brands are dedicated to sharing knowledge about geoengineering techniques, including Carbon Dioxide Removal (CDR) and Solar Radiation Management (SRM). Currently, we have nearly 10,000 readers, subscribers, and followers combined.

This year, we launched three new community resources: the CDR Events Calendar, a LinkedIn account, and a YouTube channel. Looking ahead, we plan to introduce 2-3 more information-focused brands in the first half of 2025.

To stay updated on our new launches, subscribe to our Linktree for notifications:

Here’s more information about our brands—we hope you’ll find something useful to support your work:

Reviewer 2 Does Geoengineering Podcast, delving into recent CDR and SRM research papers through author interviews.

A daily feed of news from @geoengineering1 on Twitter and BlueSky.

Our Carbon Removal Updates LinkedIn account features weekly posts on commercial news, job opportunities, and events.

Our Climate Engineering YouTube Playlist offers diverse perspectives on SRM and CDR technology. It includes expert interviews, educational lectures, project showcases, explanatory animations, and discussions from research organizations, reputable institutions, and environmental advocates.

The Carbon Removal Events Calendar is regularly updated with events, conferences, webinars, funding, and job deadlines.

Our Carbon Removal Updates Bulletin YouTube Channel offers concise (under 4 minutes) weekly updates on Carbon Dioxide Removal Technology.

The Carbon Dioxide Removal Google Group is an interactive hub for expert-level discussions and resource sharing. It is not owned by us but we contribute there daily by posting relevant stuff.